Social Entrepreneur’s Profile

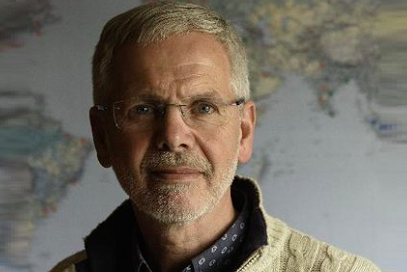

John Christensen

Tax Justice Network

The Tax Justice Network believes our tax and financial systems are our most powerful tools for creating a just society that gives equal weight to the needs of everyone. But under pressure from corporate giants and the super-rich, our governments have programmed these systems to prioritise the wealthiest over everybody else, wiring financial secrecy and tax havens into the core of our global economy. This fuels inequality, fosters corruption and undermines democracy.

The mission of the social enterprise before Corona:

Rapid globalization from the 1970s saw a rise in trade agreements and international financial transactions. But the legal infrastructure then in place had been designed largely by nation-states, not international regulatory bodies. The finer points of regulation and taxation in this new context were left largely to those who had brokered agreements. Lack of independent oversight created space for corruption and tax evasion, and by the early 2000s, an estimated US$ 8 trillion was sitting in offshore tax havens. John is responsible for designing an international network of tax justice professionals that ‘changed the weather’ on systemic tax avoidance.